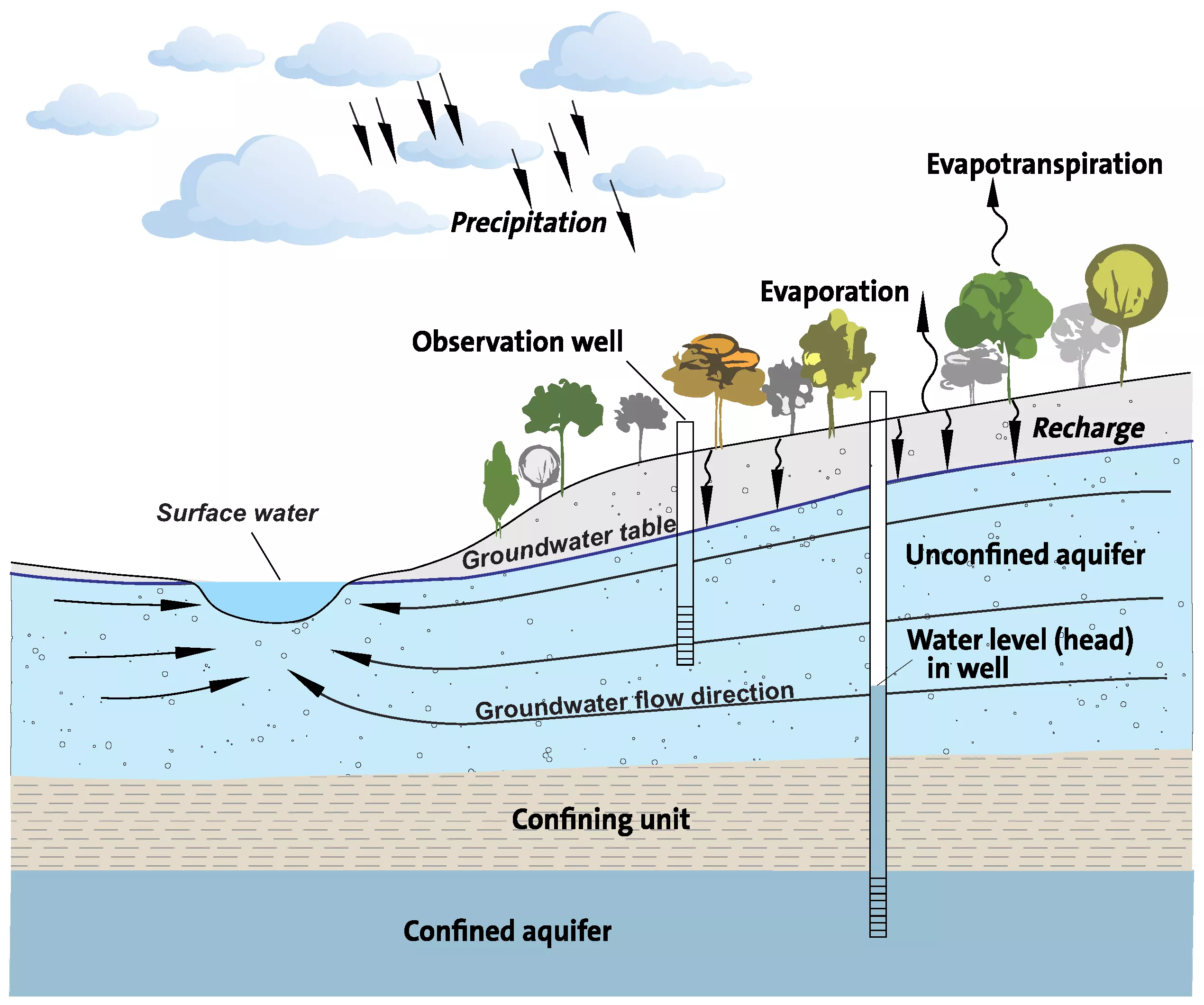

Groundwater levels across the world have shown widespread and “accelerated” decline over the past 40 years, driven by unsustainable irrigation practices as well as climate change, according to a study published at the end of January.

Groundwater is a major source of fresh water for farms, households and industries, and depletion could pose severe economic and environmental threats, including falling crop yields and destructive land subsidence, particularly in coastal areas, said the study, published in the Nature scientific journal.

“One of the most likely major driving forces behind rapid and accelerating groundwater decline is the excessive withdrawal of groundwater for irrigated agriculture in dry climates,” said Scott Jasechko from the University of California, Santa Barbara, one of the paper’s co-authors.

But drought, driven by climate change, was also having an impact, with farmers likely to pump out more groundwater to ensure their crops are irrigated, he said.

Depletion has been particularly pronounced in arid climates with extensive croplands, said the study, which analysed 170,000 wells in more than 40 countries. Northern China, Iran and the western United States were among the worst-hit regions.

More than a third of the 1,693 aquifer systems – bodies of porous rock or sediment holding groundwater- monitored by the study fell by at least 0.1 m per year from 2000 to 2022, with 12% seeing annual declines of more than 0.5 m. Some of the worst hit aquifers in Spain, Iran, China and the United States fell by more than 2 m per year over the period. In around 30% of the aquifers studied, the depletion rate has accelerated since 2000.

Some aquifers did improve over the period, in part as a result of local measures aimed at restricting how much water can be pumped out. Aquifers can also be replenished with water diverted from elsewhere. However, such recoveries were “relatively rare” and much more work still needed to be done, Jasechko said.