Avian flu control could be at risk due to U.S. health department staffing cuts

The U.S. Food and Drug Administration (FDA) is suspending efforts to improve testing for highly pathogenic avian influenza due to staffing cuts throughout the Department of Health and Human Services, according to a Reuters report.

Coal-based protein: A sustainable solution for animal feed

Brazil could be the big winner in the US-China tariff war

Nutrient-enriched invertebrates to boost feed bioavailability

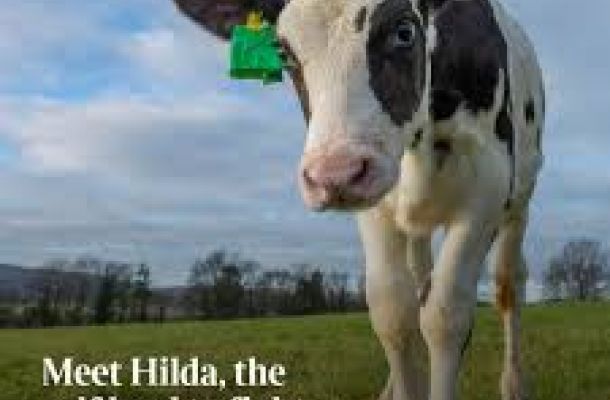

Onion peel in the cow diet to reduce methane

Foot-and-mouth disease outbreaks in Europe are associated with viruses from Turkey and Pakistan

Co-occurrence of mycotoxins remains a challenge for industry

These agriculture inputs are exempt from Trump’s tariffs

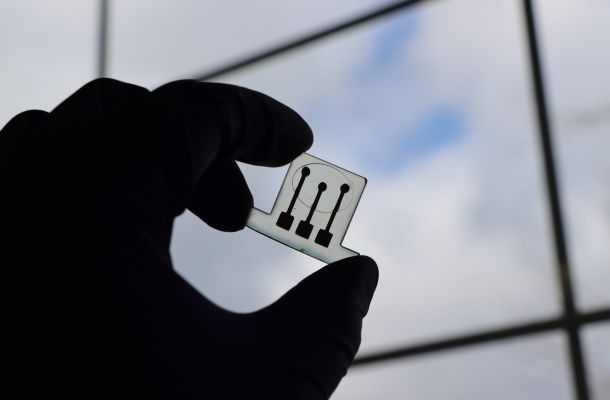

3D-printed sensors to tackle milk fever

K-State researchers develop tests to detect ASF on surfaces

Weak exports and dependence on piglet import burden Poland’s pig farms

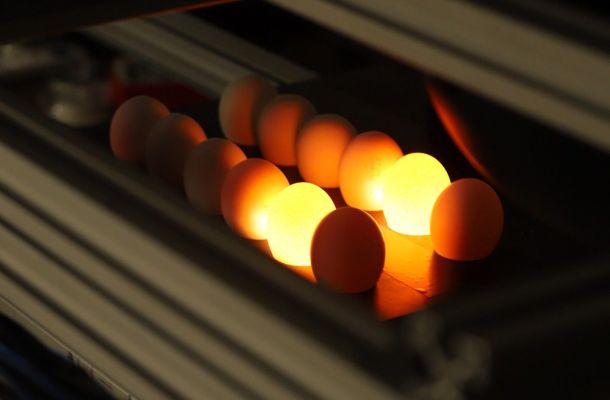

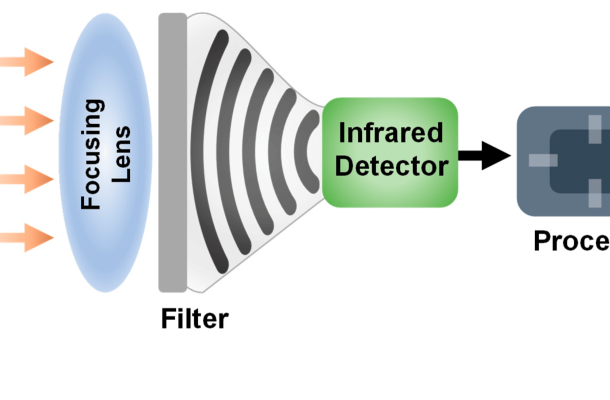

“Hyper eyes” that can see inside eggs

Record year for the Polish poultry industry

Can IVF technique halve dairy methane emissions?

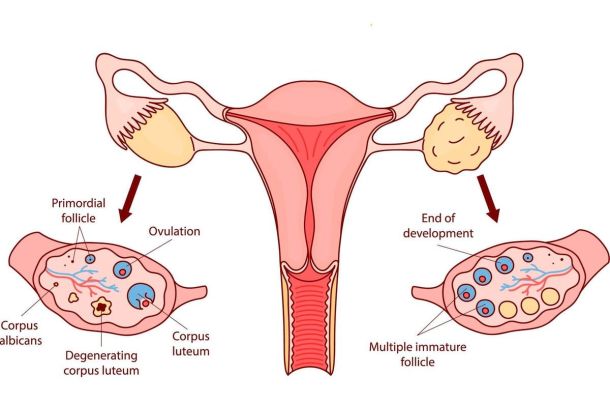

Cystic Ovarian Disease: a threat to dairy productivity in the UK

Weighing without scales wins Dutch innovation prize

EU policymakers pay attention to US university gene-editing results

Foot-and-Mouth Disease in Germany

Low-cost treatment for cow uterine infections

Pig research paves way for human respiratory vaccine development

Brazil sees opportunities to increase pork trade in 2025

Welfare, smart farming and artificial intelligence in the poultry sector

Egg shortages and high egg prices continue in the US

German feed producers face many challenges

Green light for plant gene-editing in the UK

A race for methane emission reducing vaccines

Pioneering project: producing feed from greenhouse gases

Ukrainian egg market hit with oversupply

Non-GMO supply chain unites against NGT deregulation

Operators across Europe’s non-GMO supply chain are uniting against proposed deregulation of new genomic techniques (NGTs), with a strong call for choice and transparency emerging from the recent non-GMO Summit in Frankfurt. Organized by key industry groups—Verband Lebensmittel ohne Gentechnik (VLOG), ARGE Gentechnik-frei, Donau Soja, European Non-GMO Industry Association (ENGA), and ProTerra Foundation—the event drew attention to the need for consistent non-GMO standards as regulatory pressures mount.

Alexander Hissting, managing director of VLOG, emphasized the enduring strength of Europe’s non-GMO market, affirming that the sector “is here to stay.” He is closely watching the debate on deregulation of NGTs, which could influence the non-GMO market. However, this discussion hasn’t yet reached the everyday operations of food producers or retailers, he claimed. While some have been informed and even signed letters regarding possible deregulation, they feel there’s no need for immediate action until concrete regulations are in place, he noted.

Hissting also noted that the topic has minimal media coverage and limited public awareness; most consumers likely haven’t heard about NGTs and, therefore, have not altered their purchasing habits.

He expressed concern about the future impact on non-GMO labeling standards if deregulation allows NGT crops to enter the European market without labeling. This scenario, he told us, would add complexity to maintaining non-GMO quality assurances. He emphasized that detection tools are crucial for tracking NGTs in the food chain, highlighting the importance of having affordable and practical options available.

Additionally, ENGA wants a clear liability framework based on the “polluter pays” principle, ensuring that any contamination of non-GMO products is addressed financially by those responsible.

Furthermore, the organization supports an opt-out mechanism allowing individual EU countries to restrict NGTs within their borders. Although this proposal has not yet been included in EU policy discussions, said Heike Moldenhauer, secretary general of ENGA.

Iranian company to produce single-cell proteins from methanol and petroleum compuonds

BRICS to establish an alternative grain exchange

Philippines introduces ASF vaccination to commercial farms

Treatment for dangerous turkey disease sought in the U.S.

Poultry manure to energy source

“We need to be prepared”: test developed for Japanese encephalitis virus

Type and source of fibre can affect emission from pigs

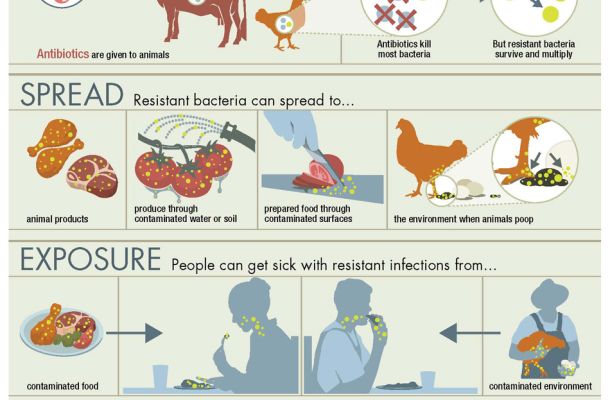

India considers ban on important antibiotics used in animal production

Irish university project to reduce greenhouse gases launches with major funding

China picks 3 large EU pork processors for dumping investigation

Grape pomace can reduce dairy cattle methane emissions

World’s first carbon tax on Danish farmers

Affects of dietary crude protein and lysine levels in slow-growing birds

Many would like to use egg vending machines

Study confirms mammal-to-mammal H5N1 spread

Dairy industry’s profitability is on the edge in Poland

Industrial fans may be a possible factor in human H5N1 cases

mRNA-based avian influenza vaccine for humans launched by Moderna

Russia provides state aid for feed additives

Europe is at odds on insects consumption – not so Singapore

Single-cell protein cultured from soybean process water looks promising

Animal feed sales down in Germany

Russia seems to be over the poultry crisis

Welfare issues resulting from feed restriction in pregnant sows

Gas sterilisation of feed considered as alternative to heat treatment

Blood biomarkers could drive broiler nutrition decisions

Challenges of using RNA vaccines in poultry

Turns out that “liquid gold” may not be gold

Cost increases and investment: the Polish dairy sector

New phytogens validated as safe for gut health of layers and pullets

3 days longer incubation makes a big difference

Animal feed sales down in Germany

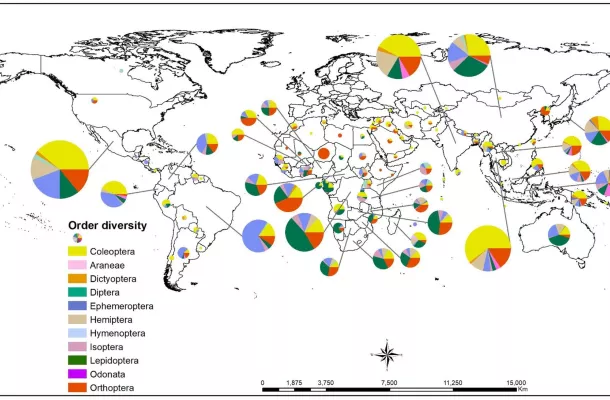

Global atlas of edible insects is available

Seed shortage threatens Russian grain farmers with bankruptcy

Supporting coccidiosis-challenged broiler chickens through nutrition

Russia launches Meat Shuttle targeting Southeast Asia

How will Generation Z expectations transform the poultry meat market?

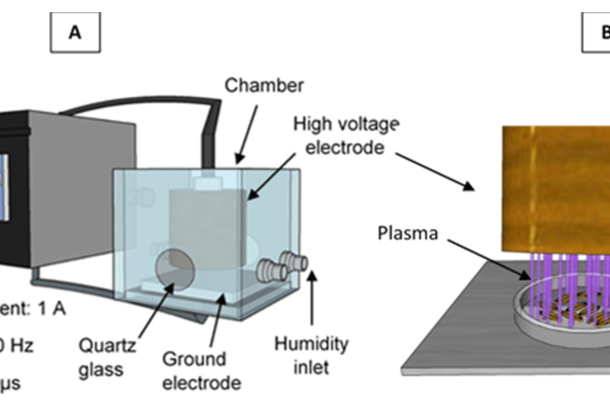

Plasma treatment reduces mycotoxins in grains

What role will circularity play in the future of feed production?

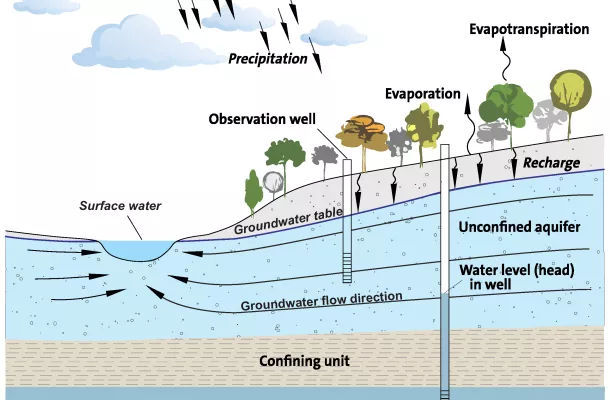

Study on the rapid decline in groundwater levels

The situation of the global synthetic milk market

Meat production in Germany falls significantly again

Dairy development plans in Kazakhstan: ambitious or unrealistic?

Epidemiological model helps prevent the spread of Aujeszky’s disease in pigs

Peroxide found most effective in hatching egg sanitation

Better pig performance with seaweed polysaccharides

Calls for EU lawmakers to ban cages for layers

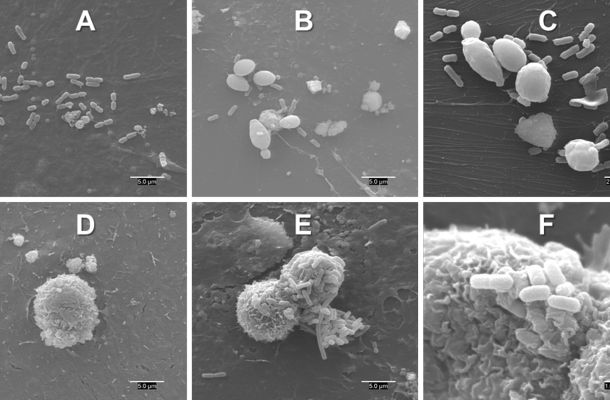

Role of three key molecules identified in the immune system of pigs against PRRSV

Cameras monitor bovine respiratory disease

US agriculture is set for its biggest price slump in 18 years

Ukraine denies it is considering a compromise on agriculture in EU talks

European Commission breaks by the growing protests of farmers

Can generative AI make poultry farms more efficient?

World pork market remains challenging

Urgent state aid is needed for the Ukrainian dairy sector

Adding yeast to poultry feed could reduce Salmonella

Effects of meat consumption on human health

WOAH warns global pig industry of sub-standard ASF vaccines

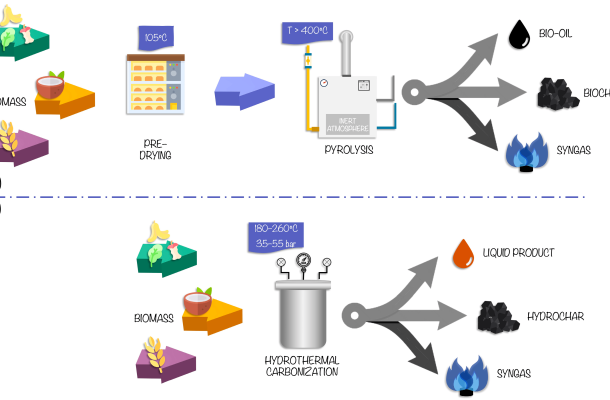

Iran to produce feedstuff from lignocellulosic waste

Synthetic cattle urine used in fight against malaria

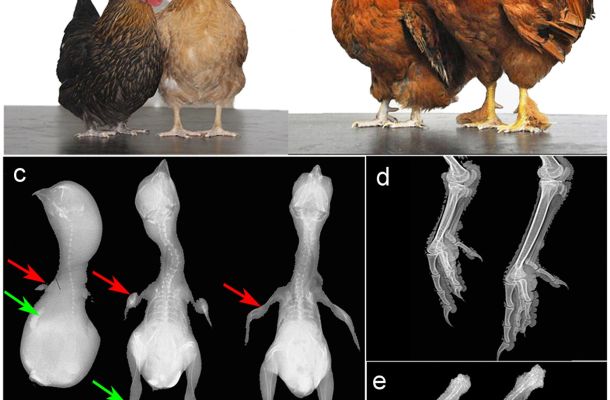

Digital radiography solution could transform poultry breeding

Escalation of the Gaza conflict will have profound, biting and worldwide impact

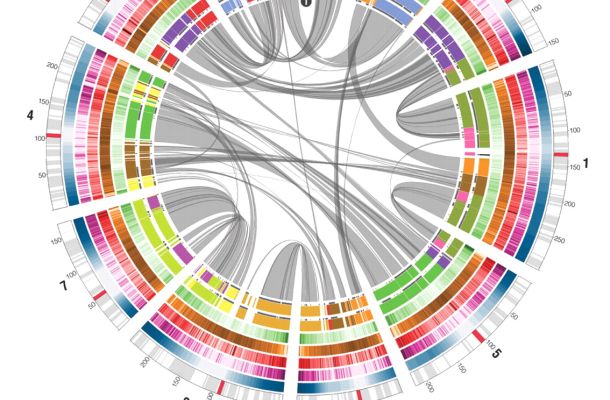

First complete corn genome map created

Environmental and dam risks of Johne’s Disease

Remarkable progress in sourcing soy responsibly in Europe

Positive outlook for the global poultry market as challenges ease

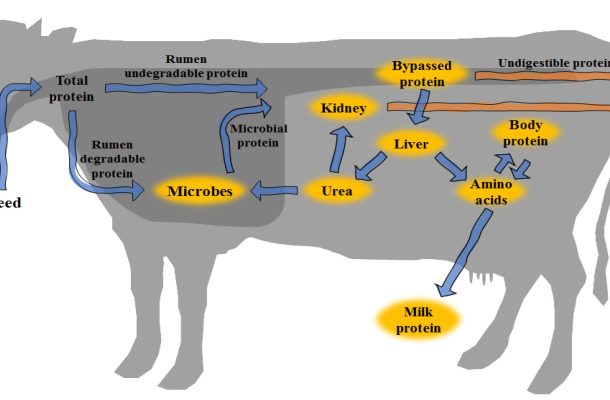

When might amino acid supplement be needed to boost milk yield?

World pork market shows steady production growth, weak consumption

Russia refuses to lower export prices: producers complain

Full article! – Positive outlook for the global poultry market as challenges ease

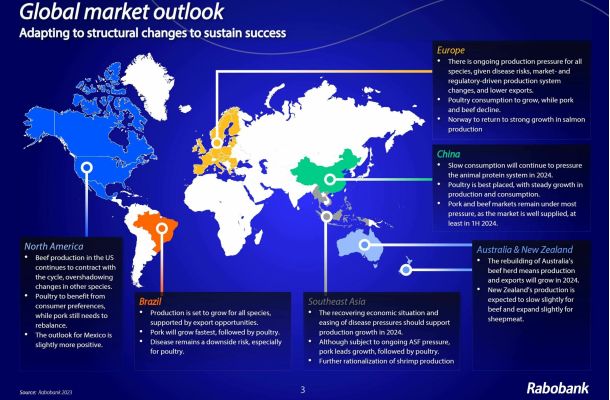

Global poultry market growth in 2023 is expected to be slow, reaching only 1%, according to a recent report from Rabobank. Global poultry markets are well positioned to gradually improve in Q4 2023 and early 2024, although the level will depend on how well-balanced they are.

After a period of slow poultry consumption growth due to a weak global economy and rising prices resulting from cost increases, global demand has room for some recovery, driven mainly by lower feed costs and, therefore, lower chicken prices. Markets will stay highly price-driven, but poultry should be able to benefit from its relatively competitive pricing in many markets compared to other proteins like beef, pork, and alternative proteins.

Rabobank sees improving market conditions in the US, Mexico, Japan, South Africa, Indonesia, and China. However, the situation in Indonesia and China will be fragile. The EU market has been strong, but high levels of fresh chicken imports are creating pressure. Brazil and Thailand face more challenging conditions and will need more supply growth discipline in oversupplied domestic markets.

Global trade is expected to stay strong in 2H 2023 after reaching a record-high 7.2 million tonnes in the first half of the year, driven entirely by increased trade of raw poultry meat, while trade in processed poultry meat dropped sharply. Amid more price-driven markets, consumers’ product preferences are changing, and this trend is expected to continue in 2H 2023 and into 2024.

Brazil is expected to benefit the most as a cost-price leader in raw chicken meat, while Thailand and China need to refocus on raw chicken trade, which will challenge these exporters’ value position.

Government interventions driven by food security, geopolitics, and sustainability will continue to impact markets and create volatility in global trade. Avian influenza will remain an important factor that could suddenly impact global markets, from both a local supply perspective and a trade perspective, especially if Brazil’s southern states are hit.

Producers should maintain focus on the operational side. Although we believe feed prices will drop slightly, operational costs are still at historic highs, and risks of further volatility exist in grain prices (due to El Niño) and in energy prices and availability. Ongoing leadership in terms of costs and procurement will remain key. Additionally, producers should fine-tune supply to changes in poultry demand related to products, distribution, and market development.

Full article! – Fighting calf coccidiosis (not only) with coccidiostats