mRNA-based avian influenza vaccine for humans launched by Moderna

The biotech company plans to use COVID vaccine technology to develop a potential treatment for future pandemics. Moderna hopes to leverage the same technology behind COVID-19 vaccines to create a vaccine that targets avian influenza in people.

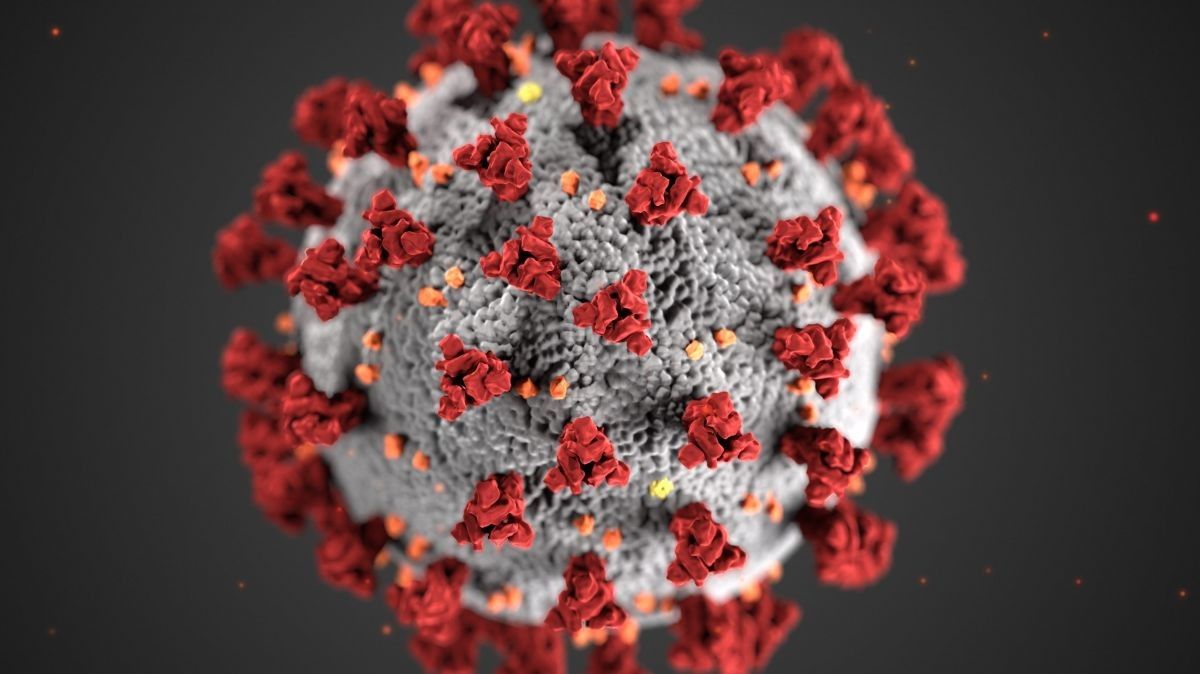

The COVID-19 vaccines use messenger RNA (mRNA) encapsulated into a lipid nanoparticle. The mRNA is genetically engineered to provide instructions on how to make a fake copy of the spike protein, a spikelike structure used by the COVID-19 virus to infect cells.

The immune system learns to recognize these foreign proteins, creating antibodies that can protect the body against future possible infections from COVID-19. One advantage of mRNA-based vaccines is that they are highly adaptable as virus strains evolve – or even, in this case, to different infectious diseases.

The company has already begun safety tests of the avian influenza vaccine candidates in a trial of healthy adults 18 years of age and older. If successful, the candidate still needs to undergo Phase III testing, which would be conducted at multiple centers across several thousand patients.